Positional Option Trading Strategies

There's a reason hedging strategies are so popular among retail traders. They're simple to use, and they can help protect your portfolio against big losses in the event of an economic downturn.

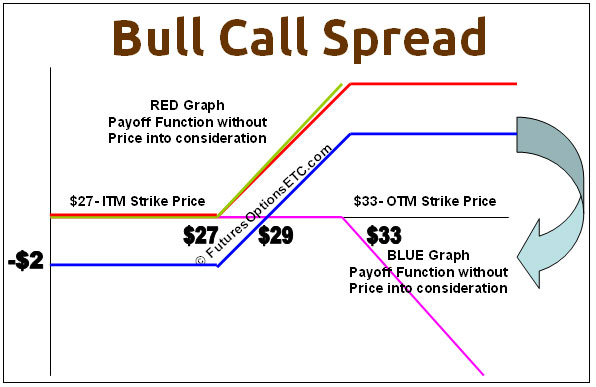

BULL CALL SPREAD STRATEGY: BUY CALL OPTION, SELL CALL OPTION

You've probably heard of a bull call spread before, but you may not be entirely sure what it is. Essentially, a bull call spread is created by buying an in-the-money call option and selling another out-of-the-money call option. This strategy is often used when the investor believes that the underlying security will experience moderate price increases.

The goal of this strategy is to offset some of the initial investment while still benefiting from any price increase in the underlying security. For example, let's say that you believe that SBI stock will go up moderately in the next few months. You could buy an SBI $115 call option and sell an SBI 120 call option. If SBI stock goes above 120 by expiration

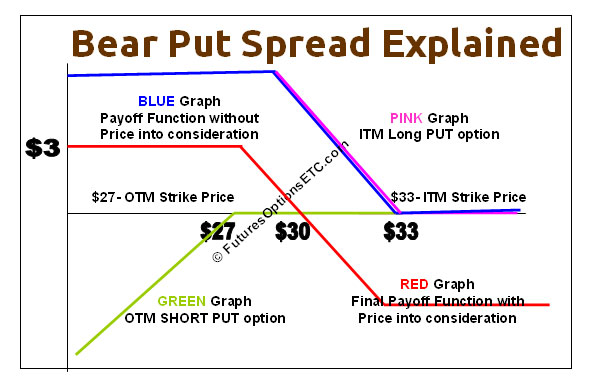

BEAR PUT SPREAD STRATEGY : BUY PUT, SELL PUT

I'm a big fan of options trading, and I've been using this strategy lately to bring down the cost and raise the breakeven on buying a Put. It's called the debit put spread, and it's really simple to do.

Here's how it works: you buy an in-the-money put option and sell an out-of-the-money put option on the same stock with the same expiration date. This strategy creates a net debit for the investor, so it requires a bit of faith in the market direction. But if things go your way, you can stand to make some good profits.

The net effect of the strategy is to bring down the cost and raise the breakeven on

When I first heard about the debit put strategy, I was a little skeptical. It sounded too good to be true! But after doing some more research, I decided to give it a try. And boy, was I glad that I did!

This strategy is really simple to execute and can be a great way to reduce the cost and raise the breakeven on buying a Put (Long Put). The best part is that it doesn't require much of an investment up front. All you need is a Bearish outlook on the stock market and you're good to go!

Successful Commodity Trading Strategies:

Commodity trading can be a lot of fun, and it's a great way to make some extra money on the side. There are a few things you need to keep in mind if you want to be successful, though.

The most important thing is to stay informed about what's going on in the market. Keep an eye on the news, and read up on trends in the industry. That way, you'll know when it's a good time to buy or sell.

Another important thing is to develop a good strategy and stick with it. Don't try to chase every hot tip that comes your way; focus on what works for you and stick with it.

Finally, remember that commodity trading is good for profit making.